Houchen Has

Nothing to Hide

(But the Truth

about Teesworks)

Tees Valley mayor, Ben Houchen

Scott Hunter

7 February 2022

The Northern Echo conducted an interview with Ben Houchen last week (4 February) in which he defended himself against recent criticism that has been levelled against him for handing over control of Teesworks Limited to two local property developers. It turned out to be an exercise in rewriting history.

Houchen begins by explaining that the idea of using the Development Corporation to regenerate the area was his, a fact which may come as news to Michael Heseltine, who was tasked in 2015 with creating a plan for the regeneration of Teesside after the closure of the steel works. Houchen had started as he meant to continue.

But the conversation quickly turned to the issue of the property developers, Corney and Musgrave. First up was the issue of why the Development Corporation hadn’t undertaken a competitive process for the joint venture that saw Corney and Musgrave installed as partners. The answer appears to be that such a process has been carried out for the construction of a business park at the airport and Corney and Musgrave’s company had won that.

That’s the business park owned by Teesside International Airport Ltd, not connected with the South Tees Development Corporation, who, in fact, don’t even have any board members in common.

He goes on the give an account of Corney and Musgrave’s involvement in negotiating with the Thai banks over the compulsory purchase of former SSI land. While preparations for the compulsory purchase inquiry were progressing smoothly in the course of 2019, the collapse of British Steel, changed everything. This was because the Redcar Bulk Terminal was jointly owned by SSI UK (in receivership) and British Steel. And SSI (the parent company of SSI UK) exercised their right to buy British Steel’s share.

Houchen insists that this put the compulsory purchase in jeopardy, as this enabled the Thai banks to put up alternative plans for the redevelopment of the land they held. (Odd, however, that the representatives of the Thai banks made no mention of this in the evidence they submitted to the inquiry). It was at this point that, in Houchen’s narrative , Corney and Musgrave came to the rescue, as the Echo explains:

“They told Ben Houchen they owned a significant legal interest in RBT - about 70 acres of land on the right hand side - and SSI were now badgering them to give them that legal interest because they couldn't really properly redevelop the 280 acres they've got without controlling the whole thing.

“Remarkably, SSI told Chris and Martin that if they gave up the 70 acres that united the RBT site, they could have the rest of the steelworks site in exchange …

“So Chris Musgrave and Martin Corney hot-footed it to the STDC and proposed a development partnership.”

It’s a pity that Houchen doesn’t put any dates on when all of this happened, because, if we are precise about dates, the story becomes even more startling. And raises a few unanswered questions.

The History of DCS Industrial Ltd

Here is the overview of DCS Industrial Ltd on the Companies’ House register:

So, the company was formed by Corney and Musgrave on 25 November 2019. We hear what they did next in the evidence presented in January 2020, in advance of the compulsory purchase inquiry:

So, four days after incorporation they took out an option on land on the bulk terminal site (so they didn’t own anything. The option gave them the right to enter into a lease within a three year period. That it is ‘LTA excluded’ means that the lessee has no right to extend it at the end of that time). This is presented as evidence that the bulk terminal had less land than it needed to operate. But given that this evidence was presented about six weeks after the option agreement was made, you have to wonder how it was that the owners of RBT didn’t see the problem coming. But, on Houchen’s account, they had no idea what trouble offering a lease on that land was going to cause them, and for that reason were ‘badgering’ Corney and Musgrave to get it back.

One thing that is surprising about the deal RBT made with DCS Industrial is that there is no mention of it in any of the documents presented to the CPO inquiry. The next we hear of the company is on 20 December 2019, when Corney and Musgrave approached the representatives of the Thai banks to negotiate buying all of the SSI land at a higher price than the Development Corporation was offering, as presented in the evidence to the inquiry by Simon Melhuish-Hancock. The last recorded in-person negotiation was on 16 January 2020. Melhuish-Hancock’s evidence, furthermore, states that Corney and Musgrave wished to buy all of the SSI land, including 100% of RBT, something which, at the time the statement was presented, the Thai banks were still actively considering.

Houchen does not refer to this negotiation in his interview, which raises the question, on what date did Corney and Musgrave ‘hot foot it’ to Houchen to unveil their ‘solution’ to the Corporation’s problems? Was it after they tried to outbid the Corporation, or before it? And if Corney and Musgrave had been offered a swap deal for RBT land against other SSI holdings, why does Melhuish-Hancock not refer to it in his otherwise detailed account? Because, given that SSI wanted the bulk terminal land back, those meetings between Thai bank representatives and DCS Industrial would have been the perfect opportunity to negotiate the swap.

The Remarkable Clairvoyance of Corney and Musgrave

In the absence of evidence to the contrary, it sounds as if, rather than coming up with a clever solution to rescue the Corporation, Corney and Musgrave were actually playing one side off against the other for their own benefit. And Houchen capitulated and bought into it.

If that is indeed what happened, then Houchen is exposed a naïve and incompetent negotiator, and his acquiescence in the game being played by Corney and Musgrave led to his being forced to accept them as joint venture partners when none was required (and we note that Houchen studiously avoids mention of the assets on the land, of which more later).

But even that is better than the alternative explanation. This is that Corney and Musgrave approached him with the ‘solution’ shortly after they had acquired the lease and before they first entered into ‘unsolicited’ negotiations with the Thai banks. If that is the case, then Houchen is complicit in planning an intervention by the property developers that may have had significant cost implications for the Development Corporation. While this may seem unlikely, it does help us to account for certain facts, that otherwise seem to be examples of a remarkable level of clairvoyance by the developers.

Were the ‘solution’ declared at an earlier date, it may help us to understand why Corney and Musgrave, in November 2019 set up, not only DCS Industrial, but also South Tees Enterprise Ltd, the company that was later renamed Teesworks Limited, and the mysterious DCS Industrial (South). The name DCS Industrial (South) first appears in the governance structure of the Corporation in May 2020, but it not referenced in any of the Corporation’s published papers. How did they know at that point that they were about to become very heavily involved with the Development Corporation?

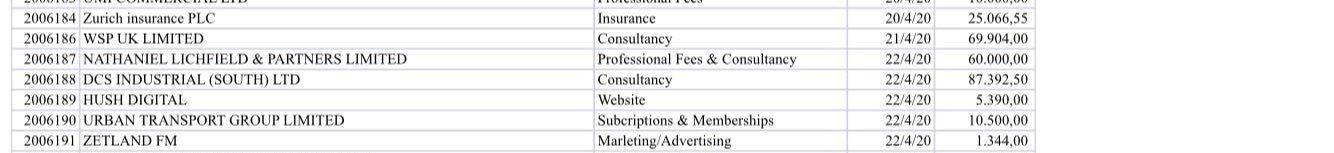

(Interestingly the only reference to DCS Industrial (South) in TVCA documents is a payment of £87,392.50. When the payment was first made, the reason for the payment was given as ‘consultancy’. This entry has recently been altered, and the reason now given is ‘legal services’. The date of the payment has also been altered:

We don’t yet know why this change has been made, save to say that, as accountancy errors go, it’s an odd one. It’s also surprising that it took two years to make the correction)

It is true that the Corporation was going to need to bring in private investors, but that was always intended to begin at the point when some of the land was ready for commercial development, not at a time when the principal tasks were remediation and decontamination (as we explained in our recent article, Who Runs Teesworks, part 2) . Corney and Musgrave essentially just interfere with that remediation work, and profit from it.

How does their participation class as ‘interference’? What Houchen omits to talk about is the revenue streams on the land – the value of scrap and aggregates that it contains. He talks in the interview only of the costs, and the fact that government funding is rapidly running out.

So, just how much is it worth? One, unverified, report gives the value of scrap steel at £6,000 per container. And for the foreseeable future, it appears that the land will be the gift that keeps on giving. The revenue raised from much of the scrap belongs to Teesworks Limited. Until the end of November 2021, the Corporation was entitled to 50% of the dividend from Teesworks Limited. Now Corney and Musgrave keep 90%. In addition to that there remain the questions around how DCS Industrial (South) earns its income.

So, well in advance of any land being ready for commercial development, Corney and Musgrave are profiting from the assets on the site. Which leaves us with another unanswered question, which is, how did they manage to persuade the Corporation to hand over so much of its value? Contrary to the account Houchen gives, this is not to do with future investment, it is to do with the profitability of the remediation work. Houchen’s claims to transparency and accountability appear, at this point, extremely dubious. The project has already consumed vast amounts of public money. We are entitled to significantly more candour from Houchen than he exhibited in the Northern Echo article.

Without further clarification it appears that the property developers are taking profits without providing sufficient investment for the commercialisation of the land to happen. If they have entered into commitments with the STDC, the evidence of that has not yet been placed in the public domain. The next time he attends for interview with an obliging journalist from the Northern Echo, he needs to be prepared to defend that.

Ben Houchen has been approached for comment on issues raised in this article